Hot off the Press: the Q3 Flex Report

Headlines proclaiming the "death of flexibility" are dead wrong

👋 Happy Wednesday! We’re going to skip “in the news” this week (we’ll be back at it next week, we promise) and get right to it — we have a new Flex Report!

We’ll tell you how to save your spot for our upcoming State of Flex webinar.

Also, some even bigger news: Flex Index is completely free! No need to be a paid subscriber to get the full report — read on for more!

Please forward to colleagues and friends! Link to subscribe

THIS WEEK’S FLEX FOCUS 🔍

Announcing the Q3 2025 Flex Report!

A year ago, most thought the "return to office" wars had settled into hybrid détente. Then Amazon, JP Morgan Chase, and the Trump administration declared flexibility dead, sparking headlines about an inevitable march back to five-day office weeks.

But workplace reality proves more complex than media coverage suggests. We've expanded Flex Index coverage to over 9,000 US firms, with deep-dives into not just policy changes, but actual compliance and business performance in partnership with BCG.

FLEXPERT INSIGHTS 🧠

State of Flex Lineup Announced!

Mark your calendar! On Wednesday, September 3rd at 9am PT / noon ET, join Flex Index publisher Brian Elliott along with Stanford Professor Nick Bloom, BCG's Debbie Lovich, and MillerKnoll’s Ryan Anderson for an in-depth discussion.

We'll dive deeper into the data, hear the latest research and case studies from Nick, Debbie and Ryan and delve deep into Q&A.

Let’s get to the data!

Flexibility continues to be the norm

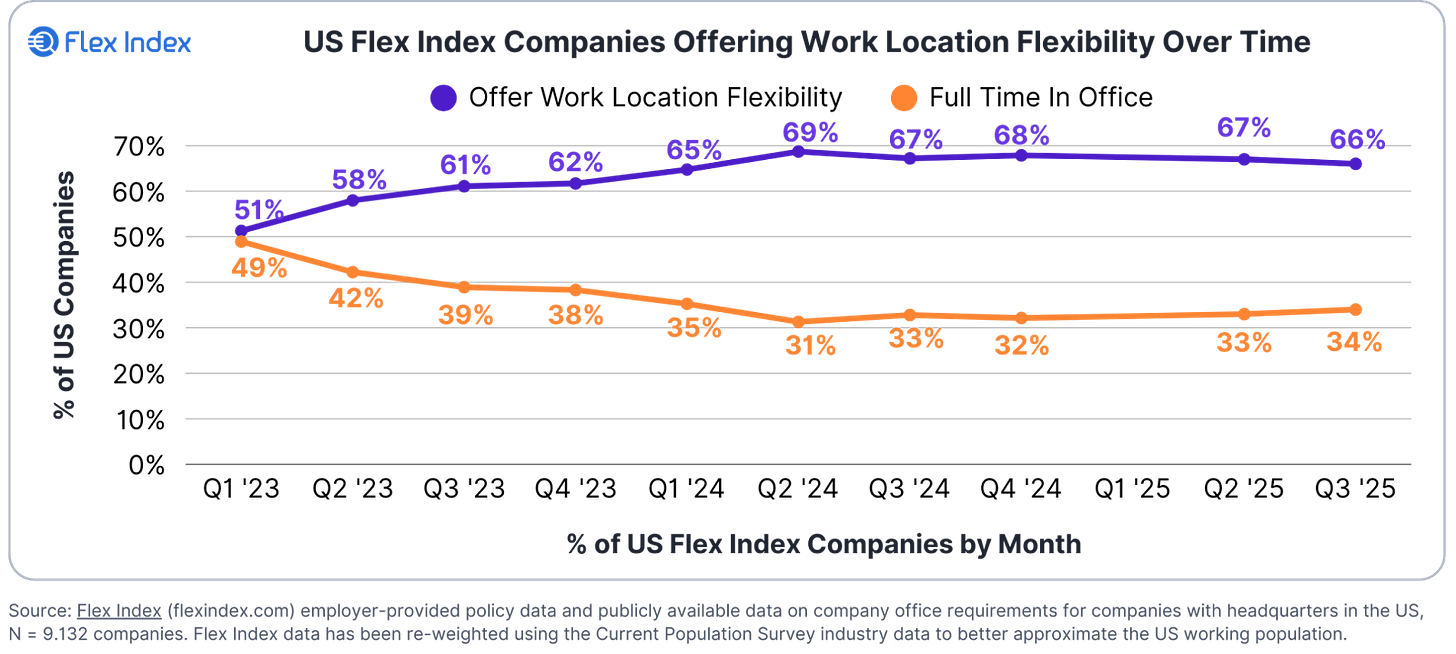

Two-thirds of U.S. firms (66%) continue offering location flexibility. Only 34% require full-time office presence – a 2-point increase from Q1 of 2024. Half of that increase was driven by federal and state government agencies.

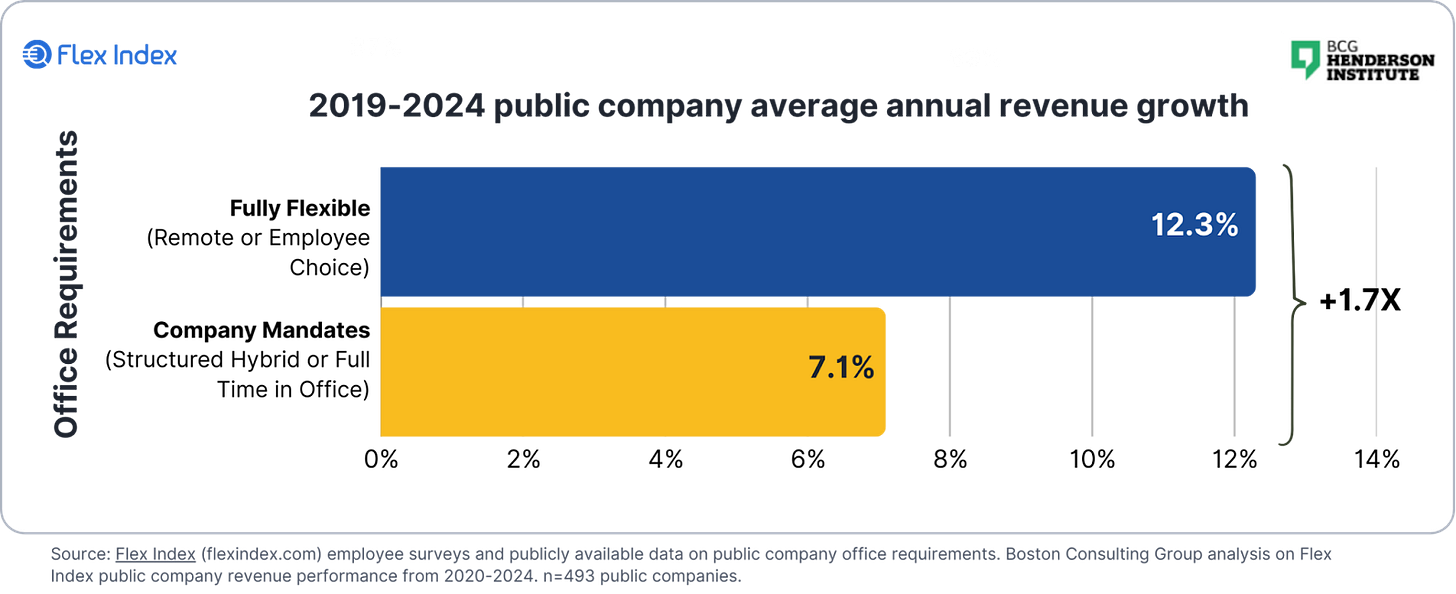

Fully Flexible firms outperform mandate-drive peers

Joint research with BCG shows Fully Flexible companies grew revenues 1.7x faster than mandate-driven firms from 2019–2024.

Even adjusting for industry and size, the growth advantage remains: growth rates 1.3X higher than peer companies. Flexibility directly impacts business performance.

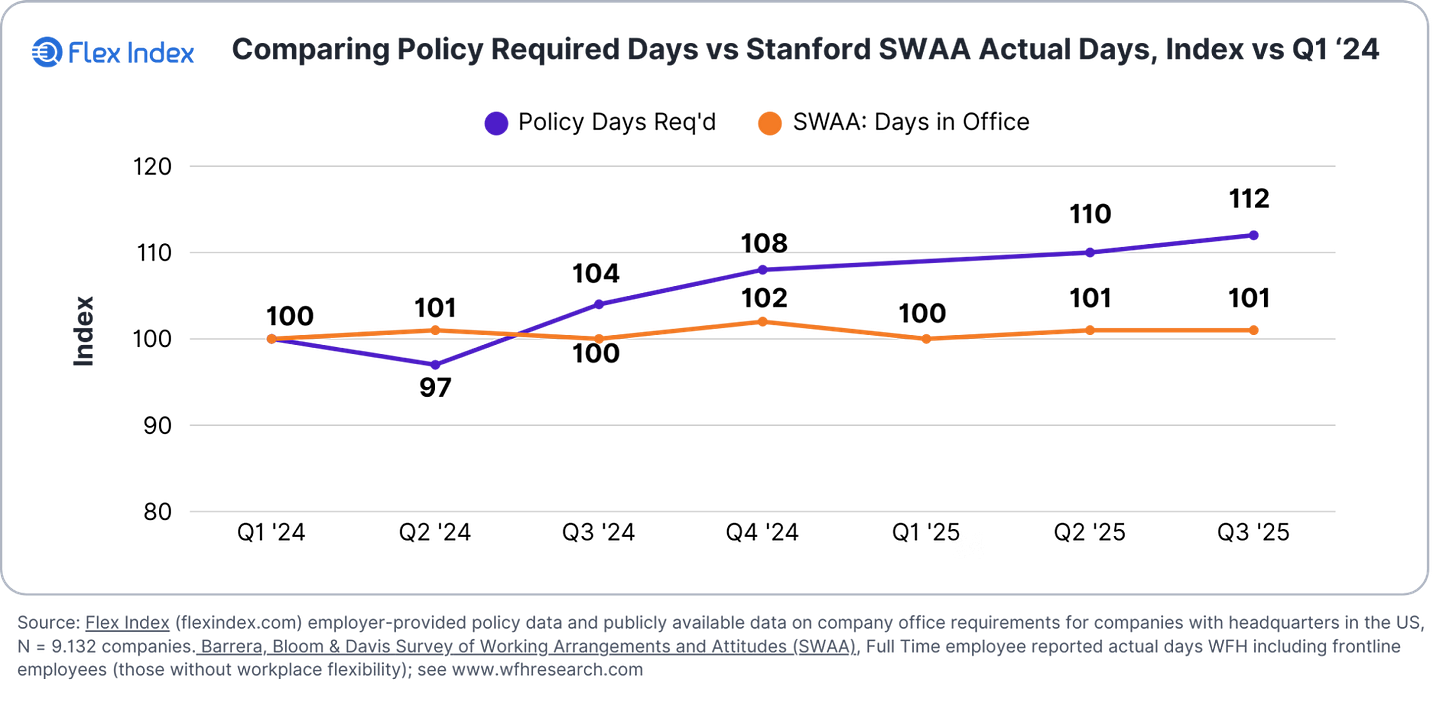

Policy is (still) not Compliance

While required office days have increased by 12% in the last year (from 2.57 to 2.87 days), actual days worked from home have moved up 1-3%. Stanford's Survey of Working Arrangements and Attitudes and the Census Household Pulse Survey show a ~1% increase – as Stanford's Professor Nick Bloom puts it, "flat as a pancake."

Other data sources are showing single-digit increases in the past year.

Placer.ai tracks cell phone activity and shows a 0% increase in Q1 ‘25 vs the year prior but a 3.1% increase in Q2 ‘25

Kastle Systems data on badge swipes has consistently shown a 2-3% increase over the past year.

More recent reports, like Placer.ai, are showing an upward trend – perhaps an indicator of further shifts to come in a softer jobs market.

Flex Index is completely free!

Earlier this year, we announced plans to share summaries with everyone, but only paid subscribers would get access to the full Flex Reports.

Then reality hit: in a world where headlines scream "Big Company Demands Everyone Back!" every week, we'd rather make it easier for leaders to ask "Is that actually true?" and find reliable answers.

So we are keeping the Flex Reports free for all to read and share. The browsing experience has always been free, as is the ability to correct our data if we got your company wrong.

If you’re a paid subscriber, we’ll be stopping the charges and gladly will provide a refund.

Special thanks to our sponsors like Kadence, who make this possible. Interested in sponsoring? Drop me a line at brian@workforward.com.

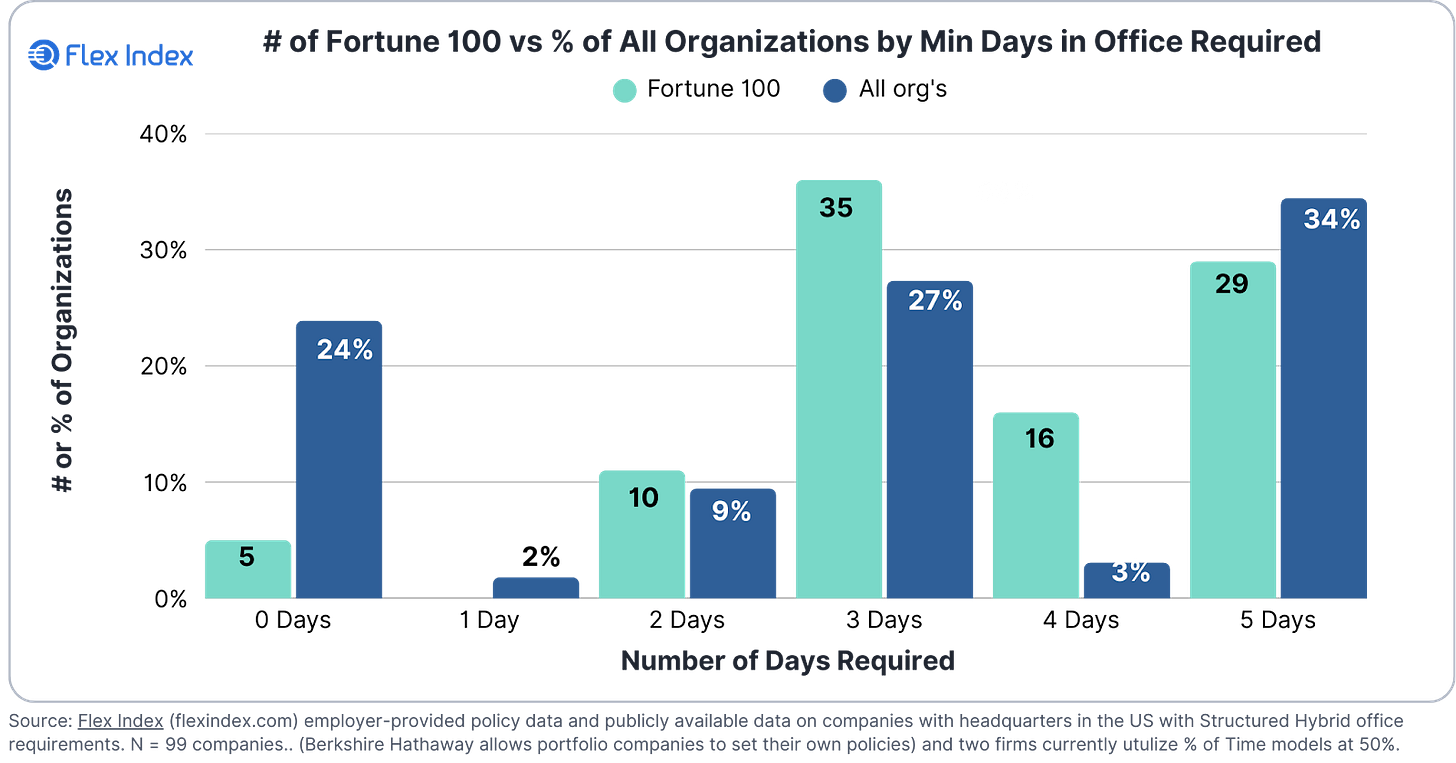

The Fortune 100 is still Hybrid, but tightens requirements

71% of Fortune 100 firms remain flexible, with 3-day hybrid as the most common policy (35%) with 29% requiring Full Time in Office. But 45% now require either 4 or 5 days in office, meaning nearly half of Fortune 100 workers are in the office almost daily.

Smaller firms aren’t following along: 67% of companies under 500 employees are Fully Flexible – and those firms are covering half the US workforce. Even excluding tech firms, smaller employers offer dramatically more flexibility than large enterprises.

What happens next?

Two critical questions will shape the workplace over the coming quarters:

Will the policy-compliance gaps close as labor markets weaken?

Will mandate-heavy large firms find their rigid approaches help or hinder their ability to compete against more agile, flexible competitors – particularly when it comes to leveraging technology and new ways of working?

Subscribe to keep up!

ONE MORE THING 1️⃣

Add your company to Flex Index

Follow Flex Index on LinkedIn

Share this newsletter with friends and colleagues