👋 Happy Tuesday! We’re going to skip “in the news” this week (we’ll be back at it next week, we promise) and get right to our big news — we have a new Flex Report!

We’ll also tell you how to save your spot for our upcoming State of Flex webinar.

Please forward to colleagues and friends! Link to subscribe.

THIS WEEK’S FLEX FOCUS 🔍

Announcing the Q2 2025 Flex Report!

The Q2 2025 Flex Report is live!

It’s been hard to miss all those splashy headlines about CEOs demanding everyone back in the office. Amazon, JP Morgan Chase, Caterpillar, and even the Federal government seem to be leading a charge back to pre-pandemic norms.

But wait — is that really the whole story?

We took a short break in Q1, but we're back with fresh insights! And what we've found might surprise you: the workplace landscape has shifted, but not how it's often portrayed in the media.

In our latest report, we've dug deep into US trends to see if those high-profile pivots to Full Time In Office are actually part of a broader movement or just isolated cases making big headlines. We paid special attention to the Fortune 500—are they really abandoning flexibility? (Spoiler: yes and no, and the story is fascinating.)

We've also teamed up with Stanford Professor Nick Bloom to explore something companies don't like to talk about: the growing gap between official policy and actual employee compliance. Turns out there's quite a difference between what companies require and what's actually happening.

Plus, we break down how different-sized companies approach workplace flexibility—with some striking patterns you'll want to see.

Ready to get the real story beyond the headlines? Dive into our latest quarterly report!

But first, some news from behind the scenes

Wondering where we disappeared to last quarter? Here's the scoop: Flex Index has found an exciting new home! We've moved from Scoop to Work Forward, with everyone who cares about this data working behind the scenes to ensure a smooth transition. We're now proudly part of the Work Forward family, and we couldn't be more thrilled about this next chapter!

Brian Elliott, CEO at Work Forward, has been an advisor and partner to Flex Index since day one. He's worked closely with Scoop co-founders Rob and Jonathan Sadow, along with the original Flex Index team, to ensure we continue delivering the workplace insights you've come to rely on.

As Annie Dean, VP of Workplace + Future of Work Transformation at Atlassian, puts it: "At the heart of every change is data—and Brian Elliott has long been one of the most trusted voices helping leaders make sense of it. Flex Index is a critical resource for companies navigating the evolving workplace, and I can't think of a better person to lead it into its next chapter."

Love what you're reading here? Check out Work Forward too—Brian's newsletter dedicated to building a better future of work for everyone. It's the perfect companion to your Flex Index insights!

FLEXPERT INSIGHTS 🧠

State of Flex Lineup Announced!

Join us on June 4th for the Q2 2025 State of Flex webinar, where we'll share the latest insights….

Four of the most respected thought leaders on the future of work — Nick Bloom (Stanford), Debbie Lovich (Boston Consulting Group), Brian Elliott (Work Forward), and Rob Sadow (Headway) — will delve into the latest data, insights, and trends in the ever-evolving landscape of workplace flexibility.

Let’s get to the data!

Flexibility continues to be the norm

Despite what you might think from news headlines, only 33% of US firms require Full Time In Office—virtually unchanged from Q2 2024. The most significant shifts have been among Fortune 500 companies, and even there, the trend is toward hybrid and 3-day-a-week policies, not full-time office mandates.

Subscription Offer: Get the Full Story

Want the complete picture on workplace flexibility from the industry's leading source? Now's your chance! While we'll continue our regular free weekly newsletter, paid subscribers will enjoy deeper access to Flex Index reports starting in Q3.

Free subscribers get the highlights, but paid supporters receive full access to our quarterly reports and occasional deep dives.

Special launch offer: Subscriptions are normally $8 monthly or $80 annually, but sign up before July 1st for just $50 for your first year—that's nearly 40% off!

The Fortune 500 shifted toward more time in office

Full Time In Office requirements among Fortune 500 firms jumped from 13% in Q4 2024 to 24% today. Companies with Employee Choice programs (where people have office access but no requirements) were most likely to switch to Structured Hybrid, while those with specific day requirements faced the highest risk of moving to Full Time In Office.

Fortune 500 companies with Structured Hybrid models also increased their minimum required days from 2.3 in Q4 2023 to 2.9 today.

Interestingly, even with these shifts, Fortune 500 companies remain slightly more flexible than the US average—though they're more likely to require 4 days in office (13% vs 7% overall).

Curious about the details? Check out the full Q2 2025 Flex Report.

Structured Hybrid and three days a week are winning the popularity contest

Structured Hybrid has become America's preferred work model, with 43% of US firms adopting this approach—up significantly from 36% in Q2 2024 and just 20% in Q1 2023. Meanwhile, Full Time In Office requirements crept up only slightly from 31% to 33% versus a year ago.

Among Structured Hybrid companies, three days a week has emerged as the clear favorite, with 66% requiring this schedule (up from 53% in Q2 2024). The national average now sits at 2.82 days per week in the office, compared to 2.49 days a year ago.

Policy is not Compliance

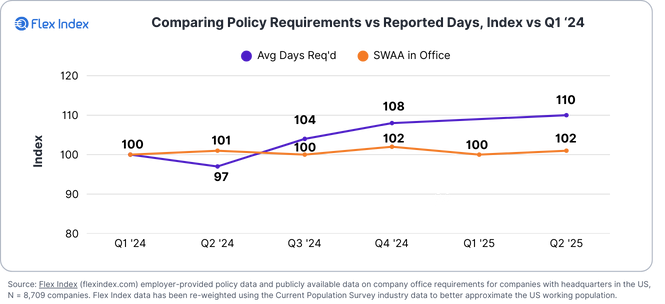

Here's where things get interesting! While required office days have increased by 13% in the last year (from 2.49 to 2.82 days), actual days worked from home have remained remarkably stable according to both both Stanford's Survey of Working Arrangements and Attitudes and the Census Household Pulse Survey.

As Stanford's Professor Nick Bloom puts it, attendance trends are "flat as a pancake."

In our latest report, we created an index using Q1 2024 as the baseline to show this growing gap between company requirements and employee behavior.

Industry and Firm Size Deviations

This is just scratching the surface! Our full report digs deeper into each factor, exploring program types and revealing fascinating patterns. We also investigate how policies differ by company size and industry—including whether smaller tech firms are following Big Tech's office-centric lead.

ONE MORE THING 1️⃣

Add your company to Flex Index

Follow Flex Index on LinkedIn

Share this newsletter with friends and colleagues