Current Subscribers: 6,746

Please forward to colleagues and friends! Link to subscribe.

The Q3 2024 Flex Report is live!

A question we’ve been asked consistently over the last 18 months — what happens to flexible work policy in the United States if the economy starts to turn south?

This summer, we’ve started to see signs of potential weakening in the US economy. The unemployment rate has ticked up from 3.8% in March 2024 to 4.3% in July 2024. Construction spending fell 0.3% in June, surprising forecasters who had expected a 0.2% increase. Economic activity in manufacturing contracted for the fourth straight month in July.

In this report, we dig into the latest flexible work policy data across US firms to see if the trend toward more flexibility in the US has continued or whether cracks are emerging with economic uncertainty. We explore what flexible work looks like across industries, company sizes, geographies, and firm ages to better understand recent developments and predict where flexible work may head in the future.

Want a sneak peek of what’s in the report? Here’s a little preview👇 We’ll also discuss the latest findings in Thursday’s State of Flex webinar.

67% of US Firms Offer Work Location Flexibility

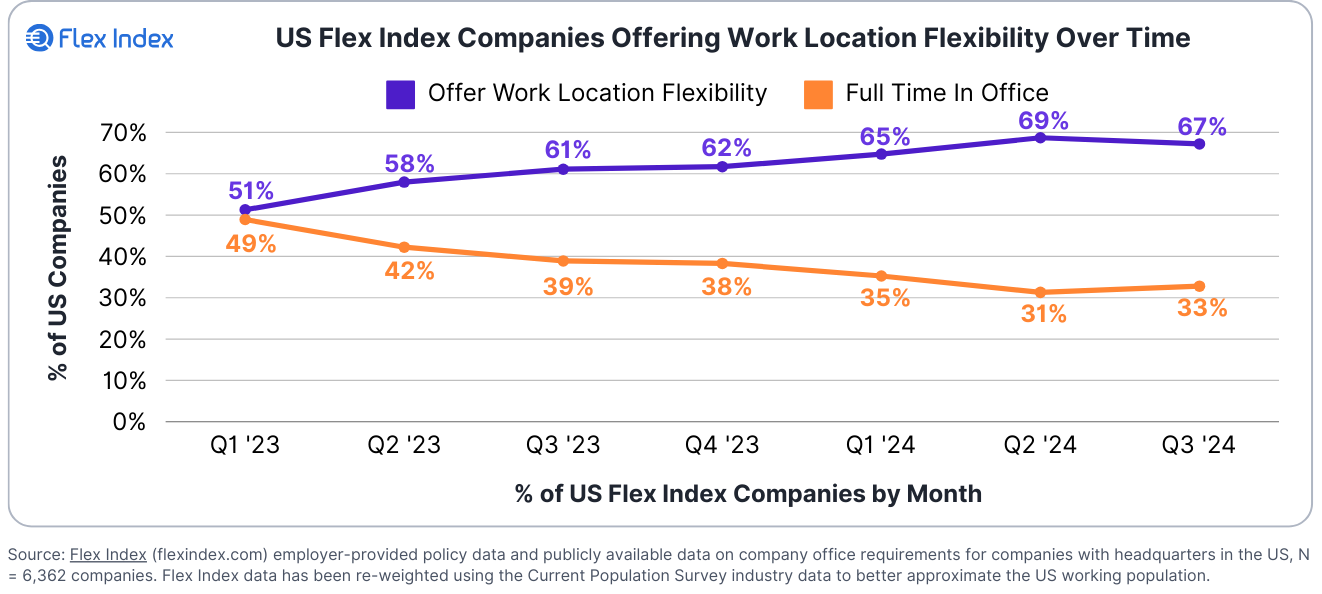

67% of US firms on an industry-adjusted basis offer work location flexibility, meaning they do not require corporate employees to work full time from the office. That represents a slight decrease from Q2 2024 when 69% of US firms offered work location flexibility.

The roughly two-thirds / one-third split on work location flexibility is a big shift from the first Flex Index quarterly report in Q1 2023. At that time, the split was about 50/50; 51% of US firms offered work location flexibility, and 49% required Full Time In Office for corporate employees.

90%+ of Firms Founded Since 2011 Offer Flexibility

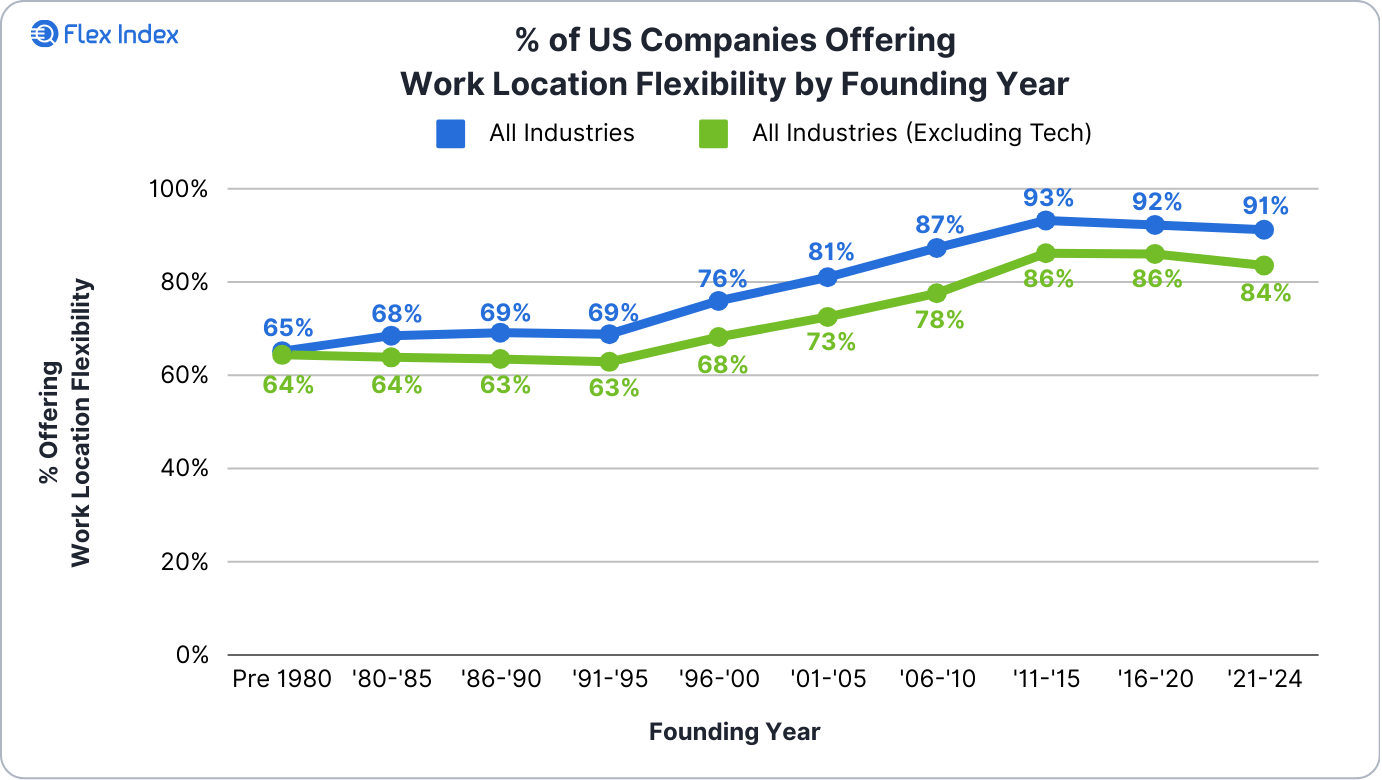

There is a significant relationship between the age of a US-headquartered firm and the likelihood that firm offers work location flexibility. Less than 70% of US companies founded in 1995 or prior offer work location flexibility; that increases to north of 90% for firms started in 2011 or later.

The relationship between firm age and flexibility holds true for larger firms as well. Less than 70% of US companies with 500+ employees founded pre-2000 offer work location flexibility; that increases to 89% for firms with 500+ employees founded in 2011 or later.

25% of Large Firms Now Require Full Time In Office

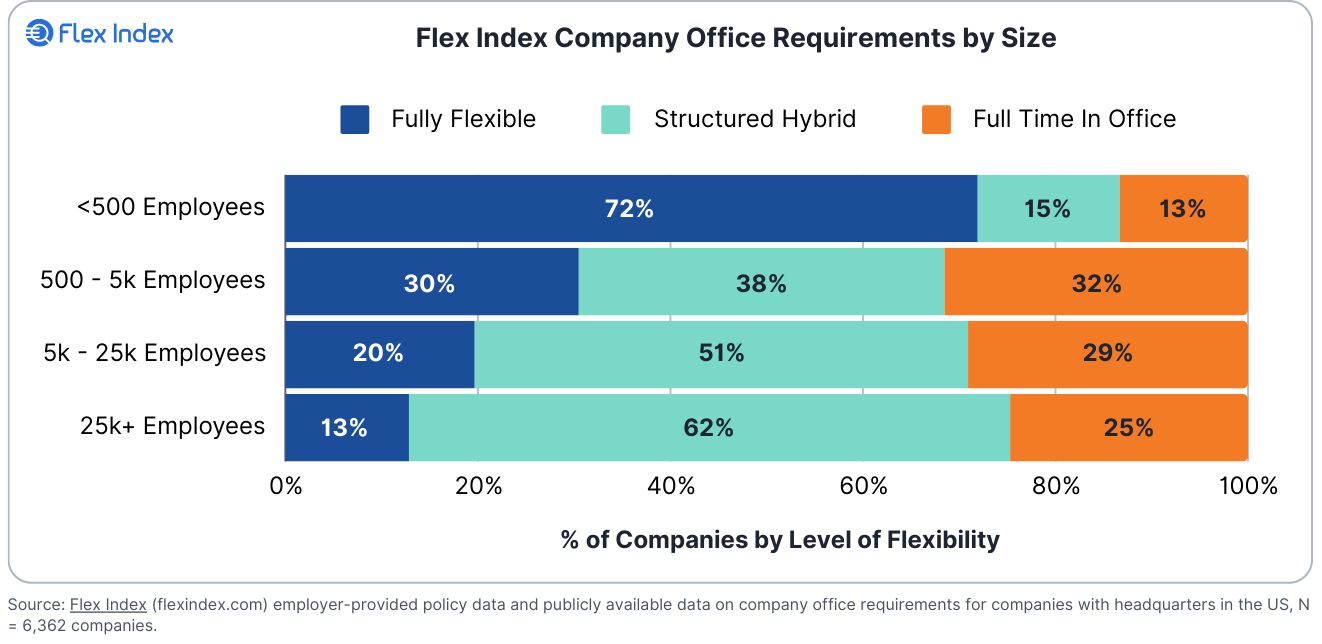

There continues to be a significant distinction in the flexible work approach between smaller firms and larger enterprises. 72% of companies with less than 500 employees are Fully Flexible, while just 13% of enterprises with 25,000+ employees are Fully Flexible.

On the other hand, large firms are much more likely to be Structured Hybrid. 62% of 25,000+ employee companies are Structured Hybrid compared to just 15% of firms with 500 employees or less.

Over the last quarter, the percentage of large firms requiring Full Time In Office increased. 25% of firms with 25,000+ employees now require corporate employees in the office full time.

FLEX WORK QUICK HITS 💥

Stay ahead of the curve with our curated roundup of the trending flexible work stories making waves right now. Here's what you need to know 👇

Fortune: CEOs abandon rigid return-to-office mandates as employee resistance and practical challenges push companies towards embracing flexible work policies.

NYT: South Korean firms revive six-day workweeks for executives, sparking concerns about work-life balance and potential spillover effects on younger employees.

Cushman & Wakefield: Companies and building owners are shifting towards data-driven amenity solutions, prioritizing employee feedback to attract and retain talent in a competitive office market.

WorkLife: To boost transparency in a hybrid work environment, one company has implemented a "No DM" Slack policy that moves nearly all conversations to public channels, enhancing information access and visibility for all employees.

ONE MORE THING 1️⃣

Add your company to Flex Index

Learn about Office Benchmarks

Become a guest ”Flexpert” contributor

Share this newsletter with friends and colleagues

FLEX INDEX | OFFICE BENCHMARKS

Office Benchmarks offers powerful insights into your office footprint, space design, and usage compared to peers with similar policies. Maximize your workplace potential and make confident, informed investments.