Current Subscribers: 7,736

Please forward to colleagues and friends! Link to subscribe.

The Q4 2024 Flex Report is live!

And you thought return to office policy was settled! For a while, it looked like 2-3 days per week in the office would be the future of work in America.

Yet this quarter has brought significant changes to the landscape. Major companies like Amazon, Dell, and The Washington Post announced their plans for a full return to office. Then came a shift in the political atmosphere, with Trump's victory and potential incoming changes requiring full-time office work for government employees.

These developments raise important questions about where workplace flexibility is headed. Are we witnessing the beginning of a broader shift back to Full Time In Office? Is the era of fully flexible work coming to an end? Or is this simply another evolution in how companies structure their workplace policies?

In this report, we dig into US-wide trends to see if the high-profile shifts toward Full Time In Office reflect broader market movement or just isolated cases. We examine how different industries are approaching flexibility, from Technology’s continued embrace to the challenges faced by sectors dependent on physical presence. Plus, we explore the divide in how companies of different sizes approach workplace flexibility.

Read on for our latest quarterly report!

Want a sneak peek of what’s in the report? Here’s a little preview👇 We’ll also discuss the latest findings in Thursday’s State of Flex webinar.

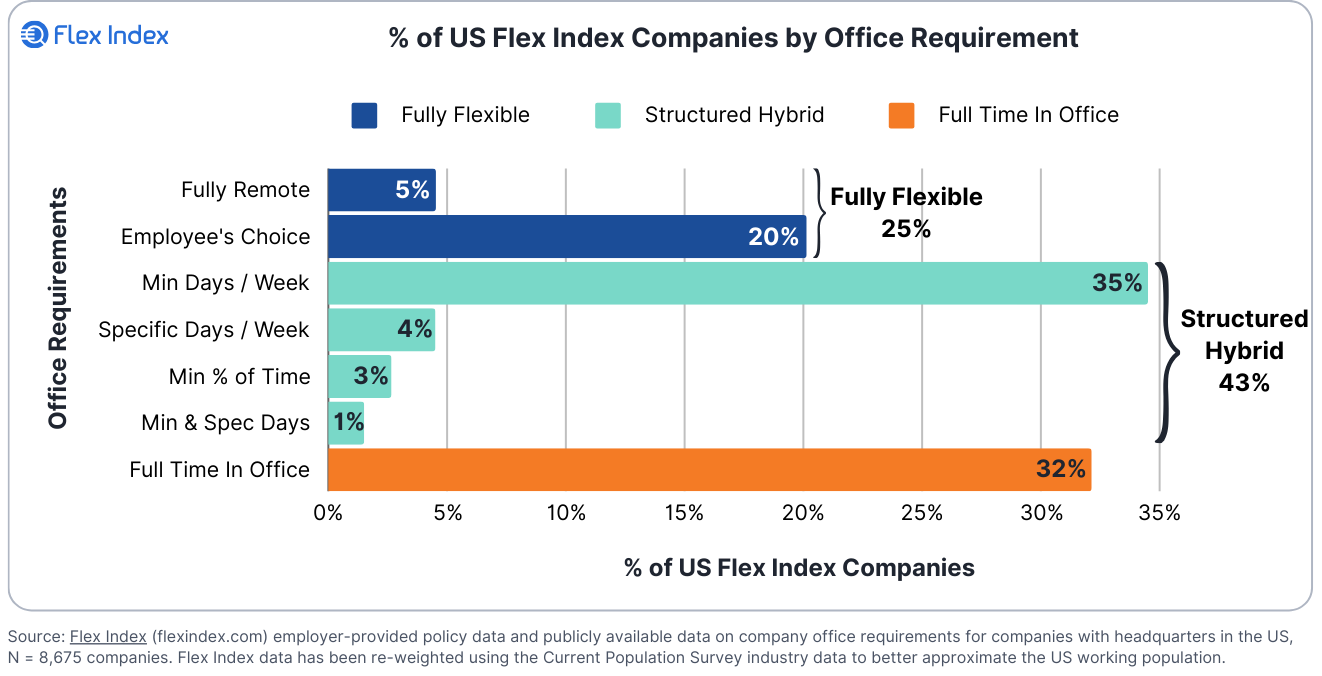

Structured Hybrid Models Continue to Grow in Popularity

Structured Hybrid is becoming increasingly dominant as the primary work model in the United States. At Structured Hybrid companies, corporate employees are not expected to be in the office full time, but there is a set expectation for how much time employees spend in the office.

43% of US firms on an industry-adjusted basis are Structured Hybrid, up from 20% in Q1 2023 and 38% in Q3 2024. Full Time In Office is the second most common work model. Fully Flexible models — where employees do not have any required office time — have dropped in prevalence from 31% of US firms in Q1 2023 to 25% of firms today

The Average Required Time in Office Per Week Increased QoQ

The average US firm requires 2.78 days per week in the office, up from 2.63 days a quarter ago and 2.49 days two quarters ago. 57% of firms have a polarized approach; 32% require Full Time In Office while 25% require no office time at all.

38% of US firms require 2-3 days per week in the office, reflective of the average. It is pretty uncommon for companies to require only one day per week or four days per week in the office; 5% of US firms require one or four days per week in the office.

Small Firms Embrace Full Flexibility, While Large Firms Opt for Structured Hybrid

There continues to be a significant distinction in flexible work approach between smaller firms and larger enterprises. 70% of companies with less than 500 employees are Fully Flexible, while just 14% of enterprises with 25,000+ employees are Fully Flexible.

On the other hand, large firms are much more likely to be Structured Hybrid. 73% of 25,000+ employee companies are Structured Hybrid compared to just 15% of firms with 500 employees or less.

FLEX WORK QUICK HITS 💥

Stay ahead of the curve with our curated roundup of the trending flexible work stories making waves right now. Here's what you need to know 👇

Yahoo Finance: As CEOs push for mandatory RTO in 2025, workers are digging in their heels, with many willing to sacrifice raises to preserve remote work.

Fortune: Major banks are mandating office returns, citing regulatory hurdles, but FINRA disputes claims that its post-pandemic rules are forcing the change.

Business Insider: Remote workers are more likely to have side hustles than office workers, with 34% juggling additional income streams.

Tech.co: A new study reveals 72% of recruiters say companies without hybrid work options are struggling to compete for talent.

ONE MORE THING 1️⃣

Add your company to Flex Index

Learn about Office Benchmarks

Become a guest ”Flexpert” contributor

Share this newsletter with friends and colleagues

FLEX INDEX | OFFICE BENCHMARKS

Office Benchmarks offers powerful insights into your office footprint, space design, and usage compared to peers with similar policies. Maximize your workplace potential and make confident, informed investments.