Texas Tech Dreams Get a Wake Up Call

Plus, there's still time to register for our upcoming Q2 State of Flex webinar!

👋 Happy Tuesday! McKinsey's latest American Opportunity Survey found that remote work has stabilized at 40% of American workers (down just 4 percentage points), with employees going to the office about 30% less frequently than before the pandemic, while 17% of recent job quitters left specifically due to changes in working arrangements.

In this week’s edition:

🤠 ATX Tech Bubble Burst?

📊 Companies Quietly Dial Up Office Time

🎥 Save Your Spot: State of Flex Live Webinar

Current Subscribers: 9,791

Please forward to colleagues and friends! Link to subscribe.

THIS WEEK’S FLEX FOCUS 🔍

Austin’s Reign as a Tech Hub Might Be Coming to an End

Five years ago, Austin was supposed to be the next Silicon Valley. Companies like Tesla and Oracle fled California's high taxes for Texas's promise of lower costs and better living. The narrative was irresistible: why pay California prices when you could build your tech empire in the heart of Texas?

The reality check has arrived, and it's stark. Big Tech employment in Austin dropped 1.6% in 2024, while startup jobs fell 4.9%. Meanwhile, the supposedly "dying" coastal cities are resurging—San Francisco and New York both posted job growth as talent flows back east and west.

RTO mandates and AI's concentration in Silicon Valley are pulling workers back to the coasts. But the deeper issue is cultural. As one former Austin transplant put it, the city lacks the innovation and diversity "deeply ingrained in Silicon Valley culture."

Austin's stumble reveals a harsh truth: geography still matters, even in our connected world. When push comes to shove, talent gravitates toward talent, networks trump cost savings, and ambitious professionals choose opportunity over affordability. The Sunbelt tech experiment isn't dead, but it's not the sure bet it seemed.

UPCOMING FLEX EVENTS 🎥

Save the Date: Q2 State of Flex Webinar

Ready for fresh insights on the future of work? Our quarterly webinar is back with game-changing data you won't want to miss.

What's to expect:

Our brand new Flex Report findings (including that eye-opening Fortune 500 deep-dive) with Work Forward’s Brian Elliott

Latest research from Stanford's Nick Bloom and BCG's Debbie Lovich

The past, present & future of the Flex Index with co-founder Rob Sadow

The best part? Our live Q&A, where we’ll tackle your toughest questions about workplace flexibility.

FLEX WORK QUICK HITS 💥

Stay ahead of the curve with our curated roundup of the trending flexible work stories making waves right now. Here's what you need to know 👇

Allwork.Space: The gap between office mandates and reality is widening—while companies demand 10% more office time since Q1 2024, actual attendance has barely budged (up less than 2%).

Business Insider: The digital nomad boom is over as RTO mandates and economic uncertainty reverse pandemic-era trends, with Indeed finding international job searches declining steeply to pre-2020 levels across the US, Canada, Germany, and Australia.

Fast Company: Hybrid work is evolving beyond home-office splits to mean human-AI collaboration, with companies shifting from using AI to replace workers to augmenting human skills for better outcomes and creating new hybrid roles.

Bloomberg: HSBC is linking UK retail staff bonuses to office attendance, requiring employees to spend 60% of time in office or with clients, following similar moves by rivals like Lloyds as banks abandon pandemic-era remote policies.

STAT OF THE WEEK 📈

Companies Quietly Dial Up Office Time

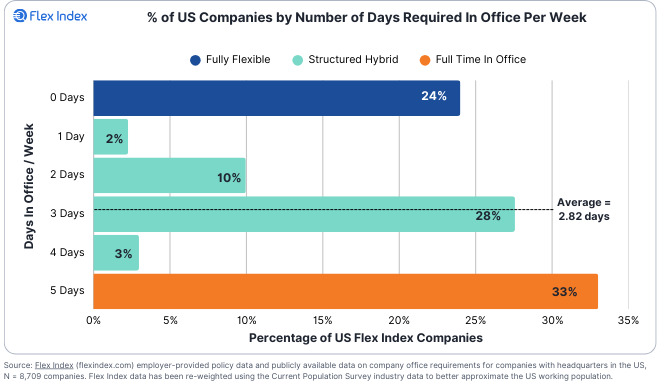

Our latest Q2 2025 Flex Report shows the average US firm now requires employees in the office 2.82 days per week—up from 2.49 days just one year ago. That's a 13% increase that reflects a clear trend.

The shift reveals a polarized workplace landscape: 57% of companies take an all-or-nothing approach, with 33% demanding full-time office presence while 24% maintain complete flexibility.

What's driving the change? Fewer companies are offering zero required office days (down from 32% to 24%), while more are settling into that middle ground of 3-4 days per week (up from 21% to 31%).

FLEXPERT INSIGHTS 🧠

Stool Legs, Trust Falls, and Tool Sprawl

While executives obsess over AI adoption and RTO mandates, their IT departments are quietly having a meltdown. In his latest Work Forward newsletter, Brian Elliott reveals the brutal numbers: 44% of IT professionals have more work than they can handle, 78% are too stressed to learn new skills, and companies want "IT unicorns" who can juggle cloud migrations, Zoom fixes, and AI governance with ever-smaller teams.

When CIOs were recently given the choice between discussing AI adoption or team connection, connection won by a landslide. Brian’s key insight: If organizations are struggling with hybrid work's "modest shifts," how will they handle AI's fundamental transformation? You can't skip the foundation and expect the house to stand—and right now, that foundation is crumblin

COMPANY SPOTLIGHT ✨

AlphaSights is a global company offering knowledge-on-demand services, primarily providing clients with access to industry experts and an intuitive platform for scheduling calls, launching surveys, and browsing relevant content. The company, operating for over 15 years, prides itself on its premium client service from locations including San Francisco and Shanghai.

The WSJ article has almost no basis in fact.

First, the Signalfire data which is the source of the decline data doesn't say what they claim it says.

1) Startup employment fell almost everywhere.

2) Austin's drop matches Boston's; so is Boston over too?

3) Only startups funded by the "top 100" VCs. How is the list defined? Likely a coastal bias.

Second, the article leans on one person who has cycled through New York, Austin, Boston, DC, and now SF in 3 years & another who is a founder of a software dev shop that didn't gain traction. Not the most credible sources.

3rd, since the article was published we have had 3 new data driven reports on Austin.

1) DealRoom ranked Austin the 5th Best Tech Ecosystem in the World

2) Carta ranked Austin with the 5th highest amount of VC funding in the US over the last year

3) Startupblink ranked Austin 6th in US & 16th Best Startup Ecosystem in World

Follow the data not the headlines