Flex Index 8/15/23: Q3 Flex Report!

Will there be a post Labor Day RTO? The latest on hybrid and remote work.

Current Subscribers: 2,845; +232 since last week

Please forward to colleagues and friends! Link to subscribe.

Q3 Flex Report

Here we go again!

It's almost Labor Day in the United States. This will be the fourth Labor Day since the beginning of COVID-19. Regular as clockwork, it also will be the fourth annual debate on whether a return to office will accelerate after the holiday.

Read through the archives of stories on return to office, and you'll find lots of articles in 2020, 2021, and 2022 stating that employees largely will be back in office after Labor Day. This year is no exception, with JLL claiming that one million additional employees will be required back in office after the holiday.

Yet looking back over the last few years, the Labor Day return to office has largely looked like...more of the same. In 2022, office usage reached 50% post-Labor Day and is still roughly there, according to Kastle.

In 2023, are we in for a change or more of the same? The labor market continues to be strong, with unemployment at a historically low 3.5%. Will companies desiring more office time succeed in luring employees back more frequently, or will a tight labor market that prizes flexibility dampen return to office plans?

In this report, we look at trends in office requirements year to date to better predict what might happen after Labor Day. We track the changes across industries, regions, company sizes, and even the year a company was founded to see how flexibility is evolving across the United States. With that data, not only can we make some predictions about the rest of 2023, but even what percentage of companies might require Full Time In Office over the long run.

Want a sneak peek of what’s in the report? Here’s a little preview 👇

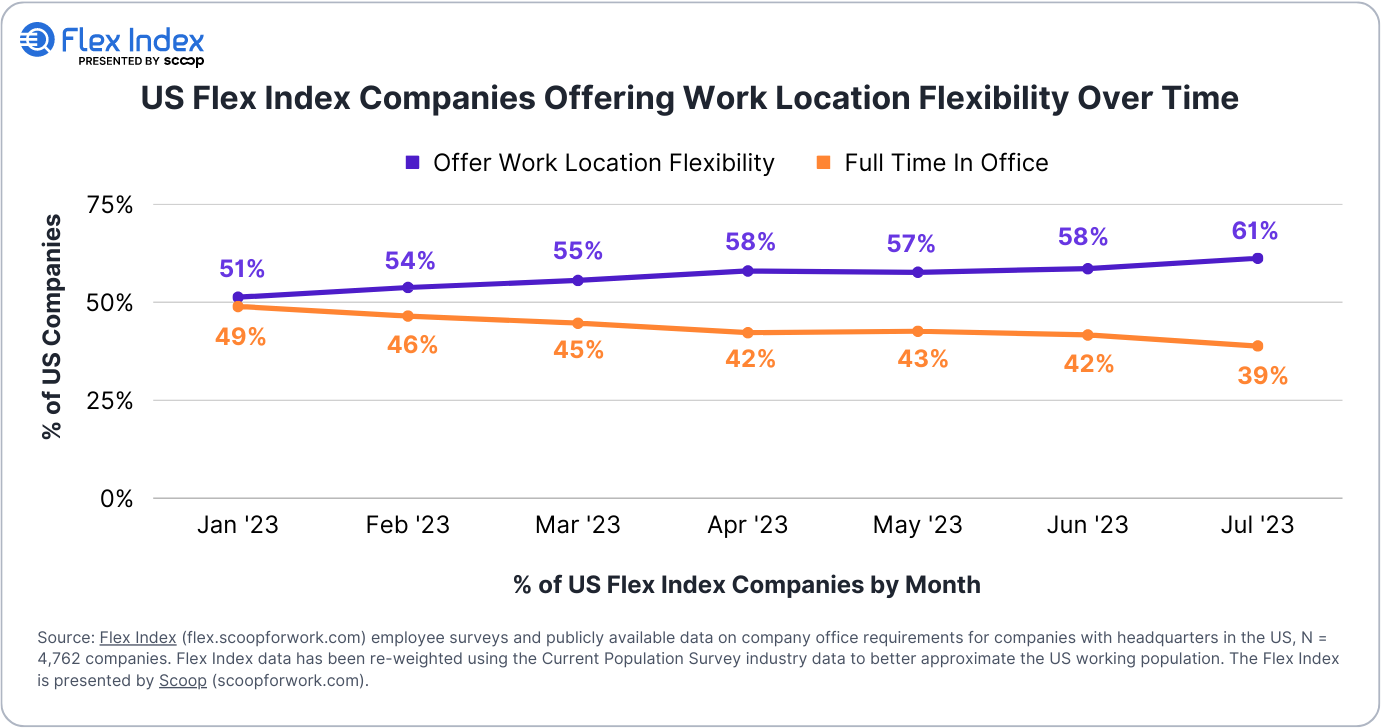

The Full Time In Office Fadeaway

Full Time In Office is steadily decreasing as a percentage of total US companies. 39% of US companies require Full Time In Office, down from 49% at the start of 2023.

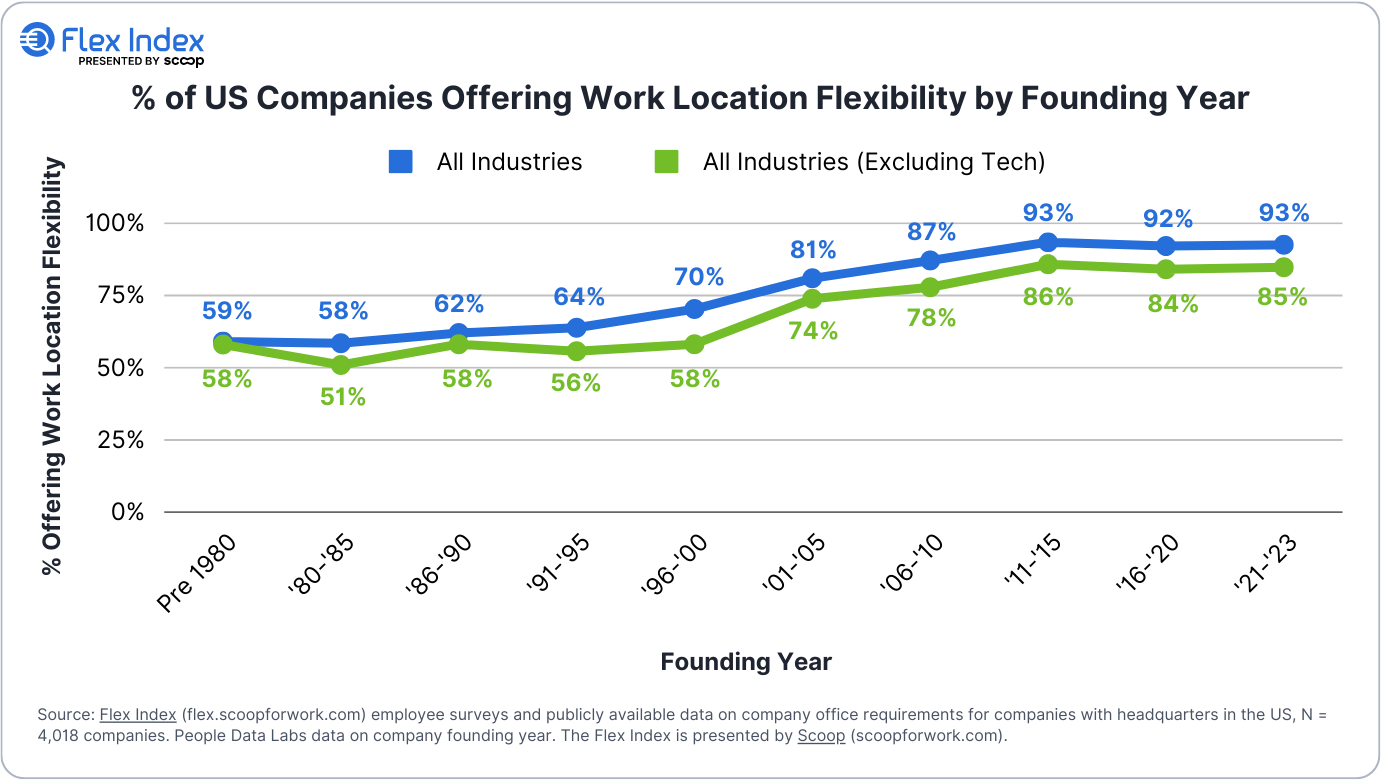

Age Matters

93% of Flex Index companies founded since 2011 offer work location flexibility. And it's not just technology companies—we see this trend across all industries. 85% of non-tech companies founded since 2011 offer work location flexibility. Companies started in the last 10-15 years are the best indicators of what work location flexibility will look like in the future.

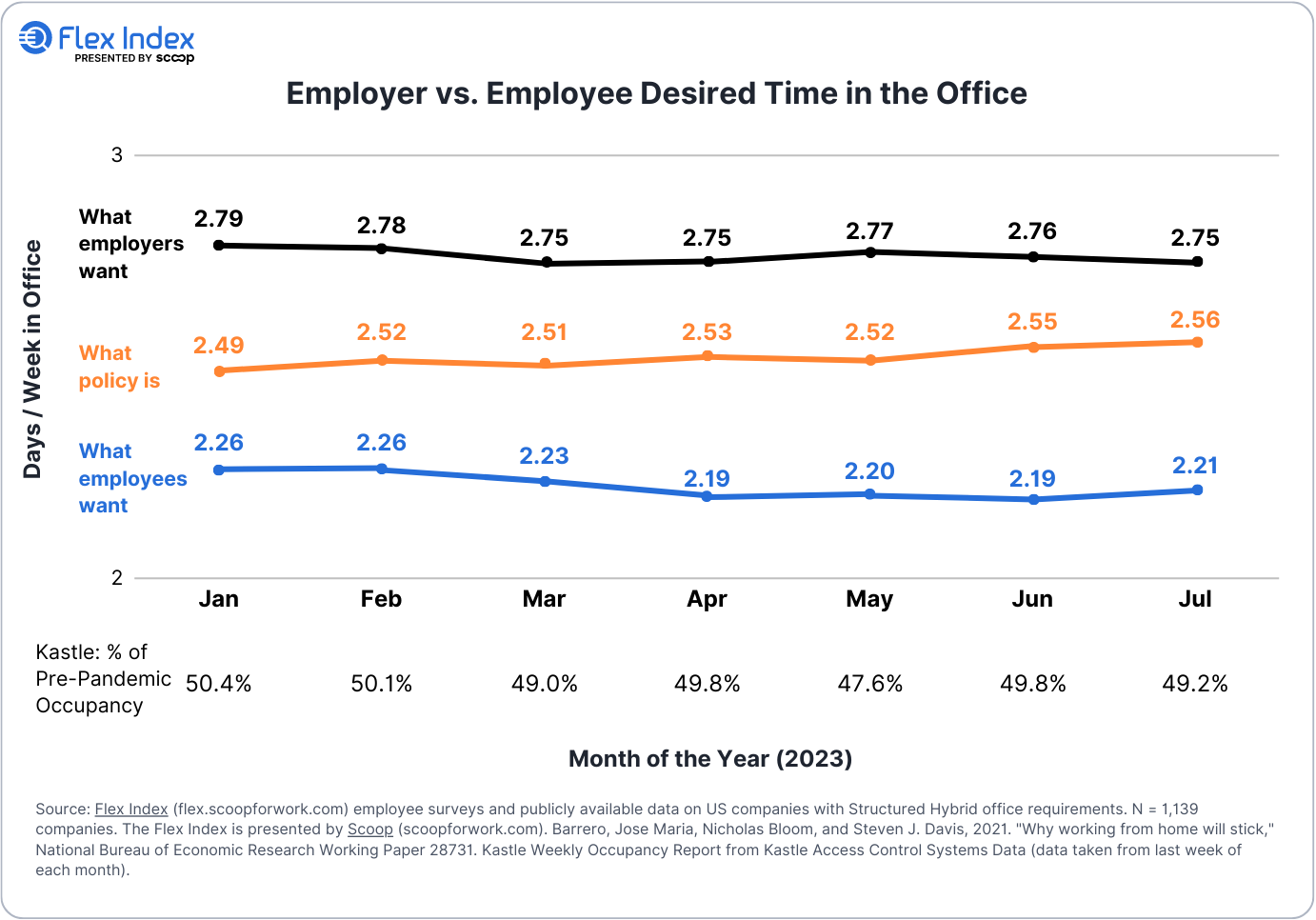

Return To Office In 2023 Has Been...Non-Existent

Companies with a Minimum Days/Week model, on average, require 2.56 days in office (up from 2.49 in January). That sits squarely between what the average employer wants (2.75 days) and what the average employee wants (2.21 days), which is likely a big reason why occupancy rates are flat year to date. There may not be much more return to office movement from here.

In the Media

Bloomberg: The headlines suggest flexible work is on the ropes – but it’s actually thriving.

Business Insider: Companies with a hybrid or fully remote-work environment are winning talent and growing staff two times as fast as less flexible companies.

Digiday: Seeing people at their desks was, at best, a blunt metric for assessing what was getting done efficiently, and what was merely time spent at a screen.

One Last Thing…

Add your company to the Flex Index with this 1-minute survey

Share this newsletter with friends and colleagues

About Scoop

Scoop is the fastest way to plan your next great office day. With Scoop, employees get more out of going in, with easily scheduled in-office days and invites. For HR and workplace leaders, Scoop provides insights on work location trends, office usage, and additional workplace solutions to get the most out of hybrid work.