Flex Index 7/18/23: The Job Growth Report!

How Office Requirements Impact a Company's Ability to Grow Headcount

Current Subscribers: 2,232; +62 since last week

Please forward to colleagues and friends! Link to subscribe.

The Flex Report: Job Growth Edition

At the beginning of 2023, the vast majority of banks, economists, investors, and executives believed that we were on the path toward recession. The Fed had raised interest rates at the fastest pace in generations. Inflation was up 6.5% over the prior 12 months. The stock market was down, and layoffs were abundant.

Fast forward to July 2023, and the economy is surprisingly strong! GDP grew by 2% in the first quarter of 2023. Inflation has dropped to 3%. The US has added a seasonally adjusted 1.67M jobs this year, and the unemployment rate is historically low at 3.6%. Perhaps a recession is on the horizon, but it's not showing up in the data yet.

In this report, we explore which types of companies are finding the most success in adding talent and whether there’s any linkage between a company’s office requirements and its headcount growth. From that analysis, we can start to draw some early conclusions on how impactful flexibility is on a company's ability to attract talent.

Want a sneak peek of what’s in the report? Here’s a little preview 👇

Flexible Companies Winning Talent

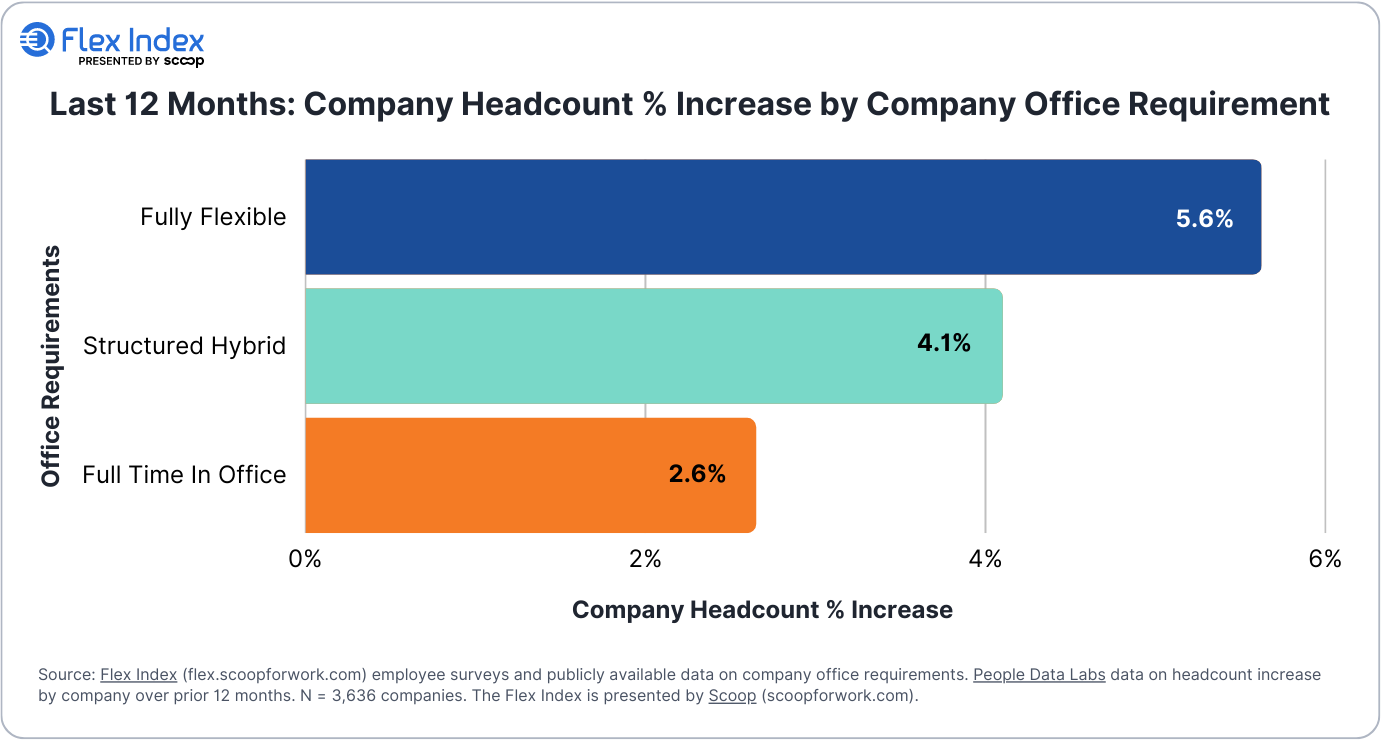

Flexible companies -- whether Fully Flexible or Structured Hybrid -- are adding headcount at more than 2x the pace of Full Time In Office companies. Fully Remote companies are growing the fastest, although these companies tend to be smaller in size.

More Office, Less Headcount Growth

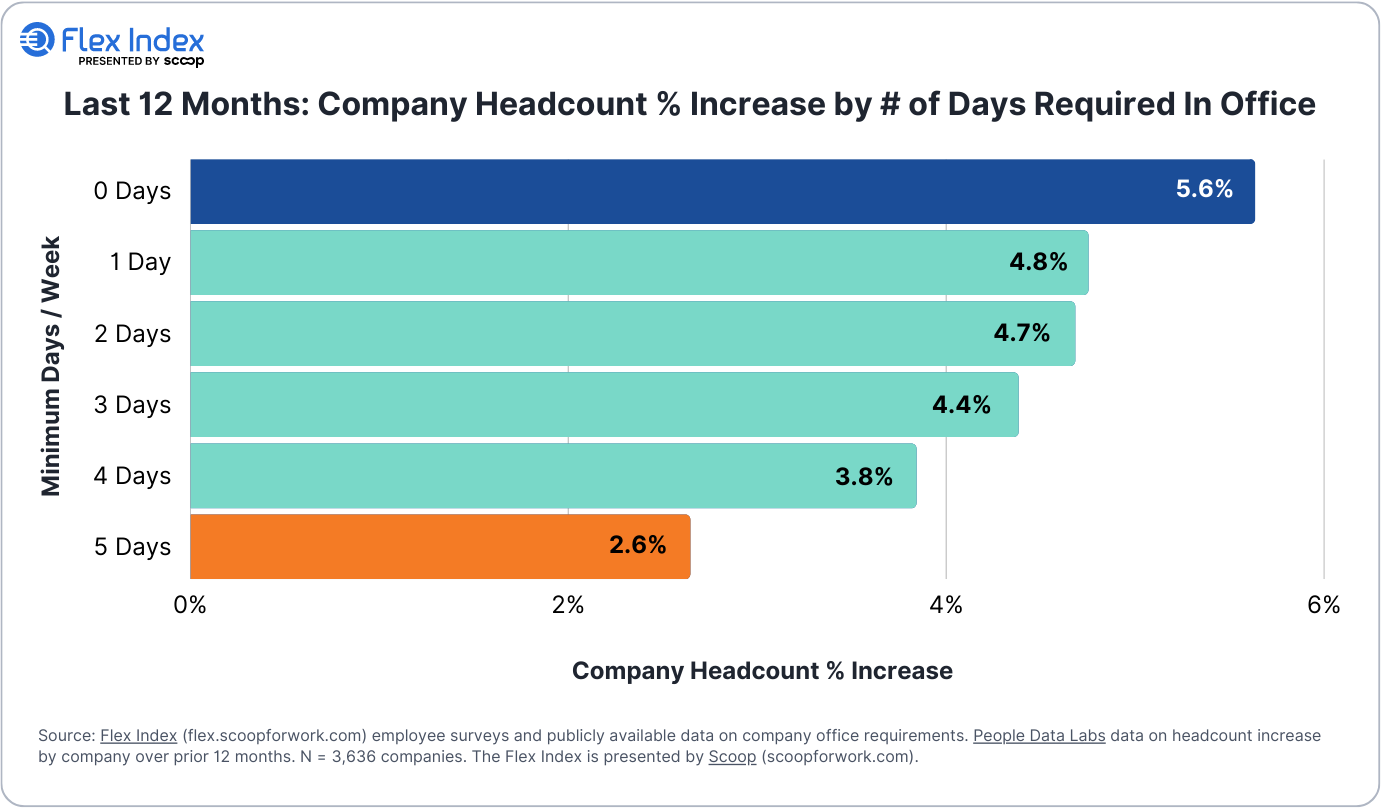

There is a strong correlation between days required in office per week and headcount growth. Companies requiring one day in office / week grew headcount by 4.8% over the last 12 months. That drops to 3.8% for companies requiring four days in office, and 2.6% for five days in office.

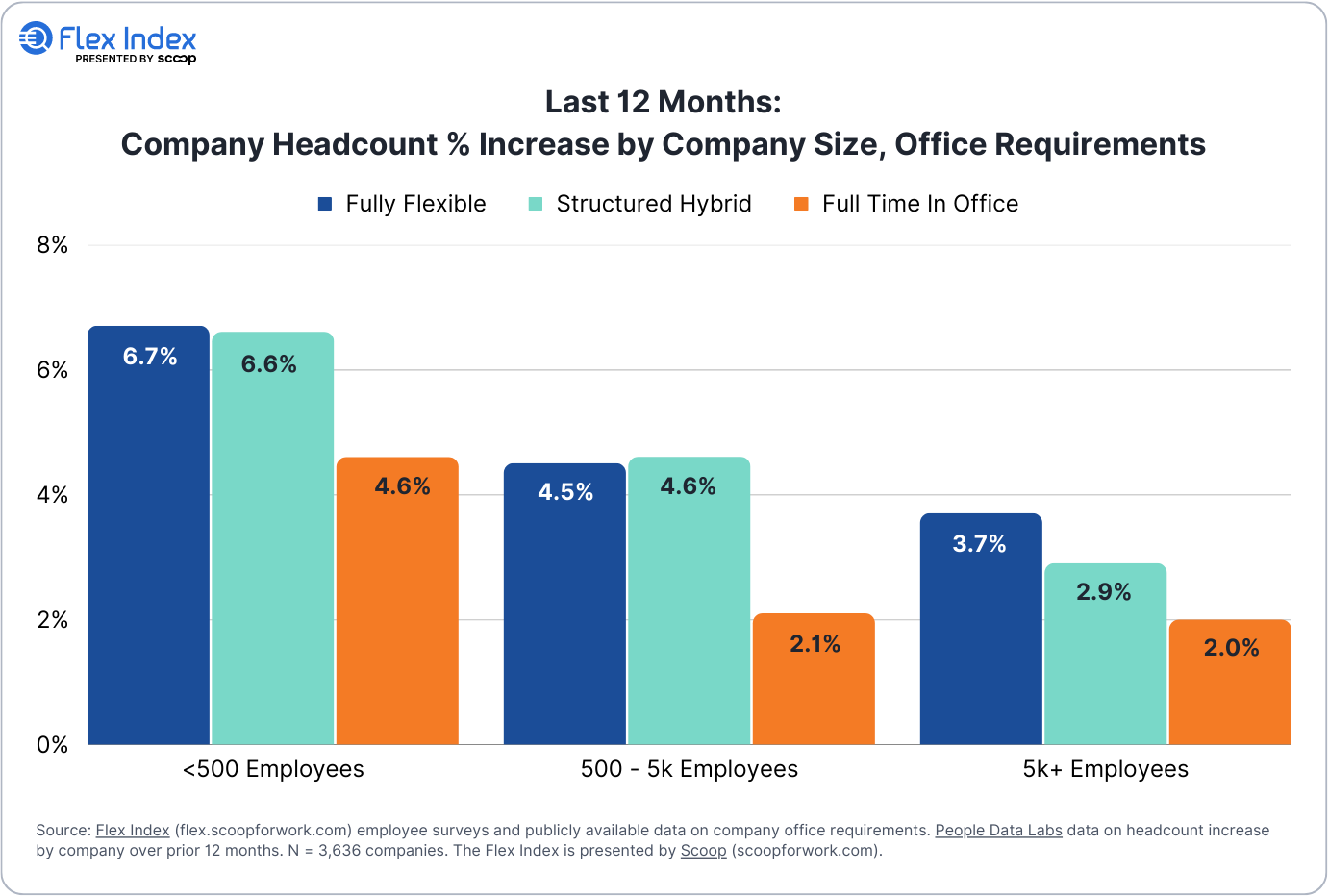

Full Time In Office Lags Across All Company Sizes and Time Periods

Flexible companies outpace Full Time In Office companies in headcount growth across all company sizes. The difference is most pronounced for companies with 500-5k employees. In that group, Flexible companies more than doubled the rate of headcount growth vs. Full Time in Office companies over the last 12 months.

In the Media

HR Executive: As employers increasingly ramp up calls for employees to come into the office, offering the ability to work from anywhere temporarily can help soften the request.

Economic Times: A whopping majority of the Gen Z workforce want to work at organizations that provide them with flexible work options.

CNBC: With some employees pushing back against return-to-office plans and the hybrid work model of three days a week in person seeming to be the sweet spot, the idea of bringing workers back to the office for a five-day workweek appears to have hit a wall.

One Last Thing…

Add your company to the Flex Index with this 1-minute survey

Share this newsletter with friends and colleagues

About Scoop

Scoop is the fastest way to plan your next great office day. With Scoop, employees get more out of going in, with easily scheduled in-office days and invites. For HR and workplace leaders, Scoop provides insights on work location trends, office usage, and additional workplace solutions to get the most out of hybrid work.